Good Morning, FoxTraa Family!

The upcoming days are very important for the forex market. Whether you are a beginner or a pro trader, understanding this analysis is a must. Today, we will discuss:

- Fed Rate Cut and Its Impact

- US Inflation and Labour Market Condition

- US Dollar Index (DXY) Technical Trends

- Trump Tariff Fear and Long-Term Market Uncertainty

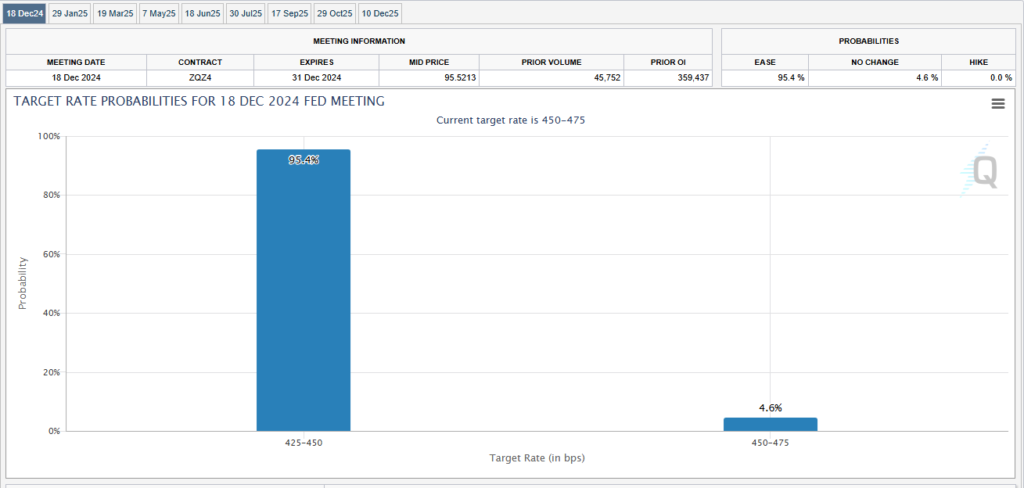

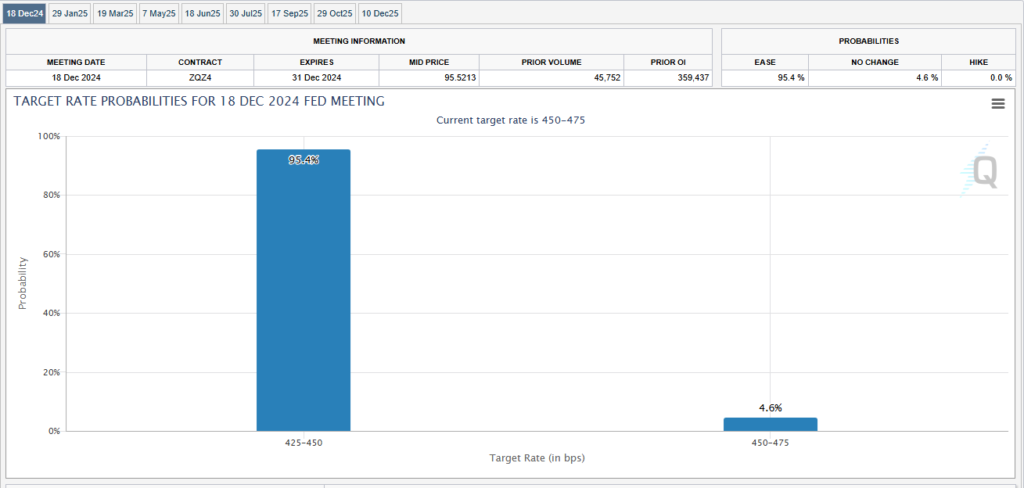

18 Dec – Fed Rate Cut Probability: 95%).

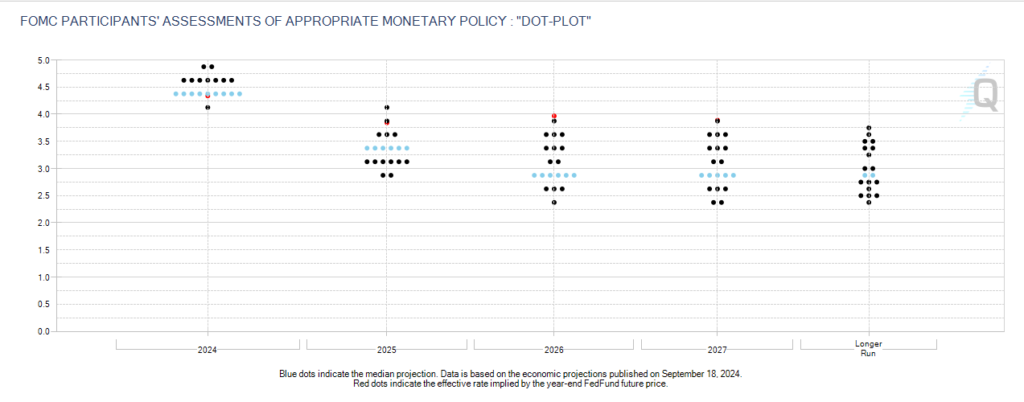

2. Fed Rate Cut Analysis – 18 December 2024

Key Insights:

- According to the Fed Watch Tool, there is a 95% chance of a rate cut on 18 December.

- The interest rate is expected to fall from 4.75% to 4.50%.

- This will be the 3rd rate cut in 2024.

Interesting Facts:

- Earlier, when rate cuts started, US inflation was 2.4%.

- Currently, inflation has risen to 2.7%.

What Did Jerome Powell Say?

The Fed will cut rates only if:

- Inflation falls to 2.0%.

- Labour market shows weakness.

But the current data says:

- Inflation is rising (2.7%).

- The US Labour Market is still strong (November Payroll Data: 227K jobs added).

What does this mean?

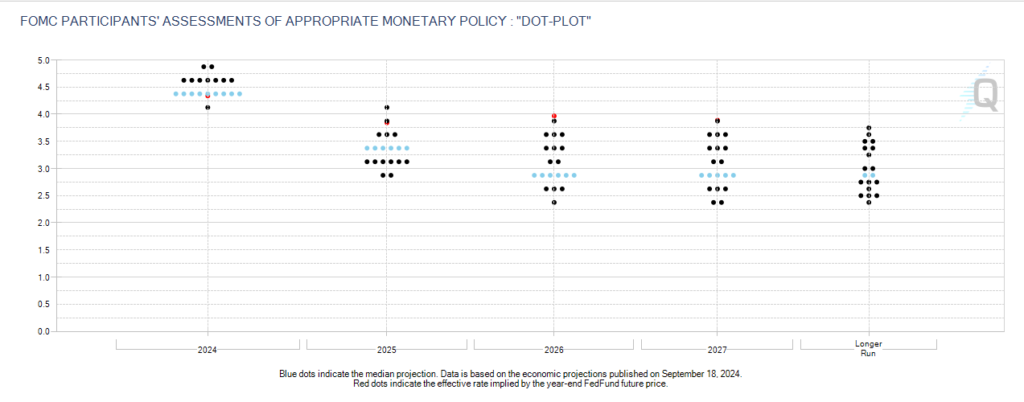

There is very little chance of another rate cut in early 2025 unless inflation comes down or the labour market weakens.

3. US Labour Market vs Inflation

Here is how the current US labour market and inflation trends look:

- US Labour Market Chart: Shows strong job growth (Payroll: 227K in November).

- US Inflation Graph: Displays how inflation has increased from 2.4% to 2.7% this year.

These charts will help you understand the gap between rate cuts and inflation trends.

U.S. Nonfarm Payrolls Data

U.S. Consumer Price Index (CPI) YoY Data

4. US Dollar (DXY) Technical Trends

The Dollar Index (DXY) is currently trading:

- Above its Weekly 7 Moving Average (MA).

- Strong support levels are visible on both weekly and daily charts.

Other Observations:

- US Treasury Yields are at weekly/monthly highs, supporting a stronger dollar.

What to Watch:

- Will currencies test their recent lows after the rate cut?

- Short-term movements in DXY are crucial for forex traders.

DXY Chart in Weekly Time frame

EURUSD Chart in Weekly Time frame

5. Trump Tariff Fear and Long-Term Impact

The market is also facing uncertainty from Trump’s policies:

- The Trump Trade Trend began in September 2024 and may continue until February 2025.

- It is unclear which countries or sectors Trump’s tariff policies will target.

Impact on the Market:

- Increased volatility in forex pairs.

- Direct effect on the US Dollar and other currencies.

Key Takeaways:

- Trump’s tariff uncertainty and Fed rate cuts will decide the forex market’s direction.

- After 18 December’s FOMC statement, major currencies might test their recent lows.

6. Summary and Conclusion

To summarize:

- Fed Rate Cut: Inflation is rising, and the labour market remains strong,

- which means rate cuts may slow down after December.

- DXY Technicals: Dollar Index is supported by strong levels and remains bullish.

- Trump Policies: Volatility may continue until February 2025 due to tariff uncertainty.

Trader’s Suggestions:

- Watch for short-term bounce back movements in currencies.

- Focus more on resistance levels (Hourly, Daily, and Weekly Moving Averages).

- Be prepared for high volatility after the 18 December FOMC statement.

What’s your view?

How do you think Fed rate cuts and Trump policies will impact the forex market?

Share your thoughts in the comments and use FoxTraa’s advanced tools to plan your strategy.

Stay updated, stay ahead!